By Fred Novomestky, Ph.D

Alchemy is one of those magical words that bring to mind the workings of a medieval magician or sorcerer. They would transform base metal to gold. Another interpretation of the word is “the process or power of transforming something common into something special.” In the blog Managing Downside Loss with Gold, we used the Upside Reward Downside Loss Frontier chart to both highlight the potential value of gold to both enhance reward but minimize downside loss. We also explored allocations to individual asset classes and portfolios that resulted in minimum downside loss. Let’s see how well we can transform into something special the downside loss and upside reward of portfolios of financial assets by including precious metals or gold by itself.

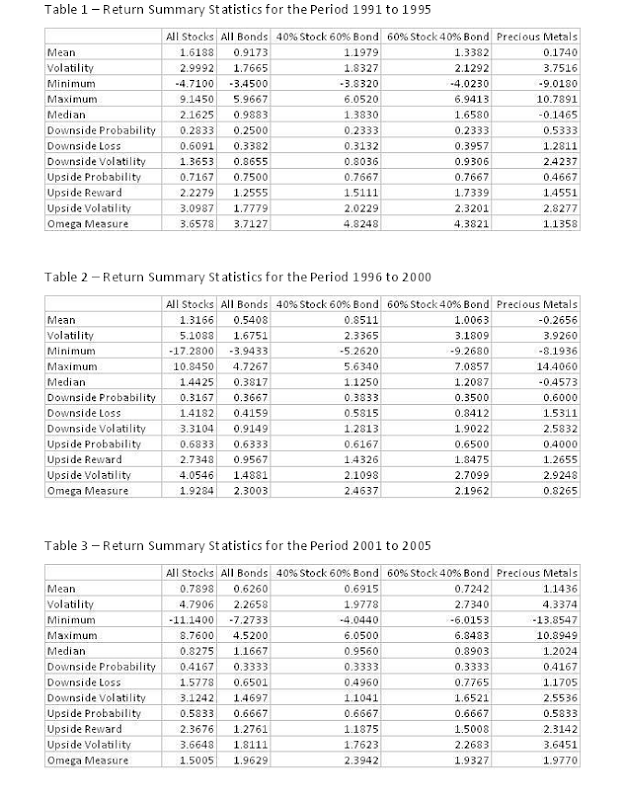

We maintain the same empirical framework that has been used in the past several blogs. We observe the performance results of four distinct portfolios: all stocks, all bonds, 40% stocks 60% bonds and 60% stocks and 40% bonds. These portfolios are analyzed over four non-overlapping time periods: 1991 to 1995, 1996 to 2000, 2001 to 2005 and 2006 to 2010. The basic portfolios are assumed to be passively rebalanced to the corresponding asset mixes at the beginning of each month. Tables 1 through 4 summarize the return statistics for each of the portfolios and precious metals and for each time period. The reader should refer to the blog Portfolio Strategy and Gold [include a link for this blog] to see the corresponding statistics for gold futures. The investor should be concerned about the observation that the downside loss for precious metals has been greater than most portfolios across most of the time periods.

The blog Blending Financial Assets and Precious Metals has shown that the weak or negative correlation of financial assets with precious metals can be the magic ingredient for transforming downside loss. When you look at the correlation coefficients in Table 5 that compare and contrast the correlation of the portfolio returns with both gold alone and precious metals, you get a sense of how dynamic these relationships are. Furthermore, with gold and silver equally weighted as we recommended in All That Glitters Is Not Gold, the resultant mix appears to be more correlated with the asset portfolios than gold alone.

Figures 1 through 4 present the upside reward to downside loss efficient frontiers for the four portfolios. The minimum downside loss portfolio changes over time with corresponding exposure to gold and precious metal summarized in Tables 6 and 7, respectively. The first piece of alchemy is the reduction of downside loss when asset portfolios are combined with gold and precious metals. Tables 8 and 9 summarize the effect. For example, the downside loss in Table 8 for All Stock without gold is the measure for the portfolio with 0% exposure to gold. The downside loss for All Stock with gold is the measure for the minimum downside loss portfolio. In all cases downside loss for a portfolio with gold or precious metal is less than or no worse than the downside loss for the portfolio with financial assets alone. Yet, it is hard to see the difference between gold alone and precious metals.

Let’s take a look at the effect of gold and precious metals on getting the best upside reward. Tables 10 and 11 show the allocations to gold and precious metals, respectively, that are associated with the maximum upside reward. It is disappointing to see that you either have no exposure to these commodities or convert the entire portfolio to a commodities portfolio. The problem is the static nature of the asset allocation process with the passive rebalancing to fixed exposures to financial assets and the commodities. Commodity trading advisors (CTA’s) are adept at dynamically adjusting the exposure to commodities to get the greatest value to investors. Tables 12 and 13 show the effect of our passive strategy with upside reward improving with or without the use of commodities in a rather naïve and unrealistic manner.

We’ve seen how gold and futures can transform conventional downside risk in financial asset portfolios into something special. To get the best improvement in upside reward requires a more dynamic investment strategy.

Click to Enlarge

Sponsored by: EMA Softech

No comments:

Post a Comment